The ongoing tariff war has had limited impact on Chinese brands expanding into the USA. Luckin Coffee, Heytea, and Pop Mart are proving that Chinese companies can win over American consumers even amid tariff threats and political scrutiny.

Their success underscores a bigger trend: rather than being deterred by trade barriers, these brands leverage innovation, competitive pricing, and sharp cultural adaptation to carve out space in one of the world’s toughest markets.

Why Chinese Brands Are Looking Overseas

Slowing growth and fierce competition in China’s domestic market are driving consumer-focused companies to search for new frontiers. As Professor Arthur Dong of Georgetown University explains, the hyper-competitive environment at home motivates leading firms to look outward. The U.S., with its massive consumer base and openness to fresh concepts, presents an attractive stage for ambitious Chinese brands.

Navigating Tariff Risks

While tariffs remain a looming risk, not all brands face the challenge equally. Product-heavy companies like Pop Mart, which export collectible toys, are directly exposed to tariff fluctuations that could raise costs and squeeze margins.

In contrast, service-based businesses like Heytea and Luckin Coffee are less vulnerable since much of their value is created and consumed locally in the U.S. Unless they depend heavily on importing ingredients from China, these brands operate with relative insulation from tariff hikes—a strategic advantage in an uncertain trade environment.

5 Key Takeaways for F&B Owners Expanding Internationally

1. Target Younger, Trend-Setting Consumers

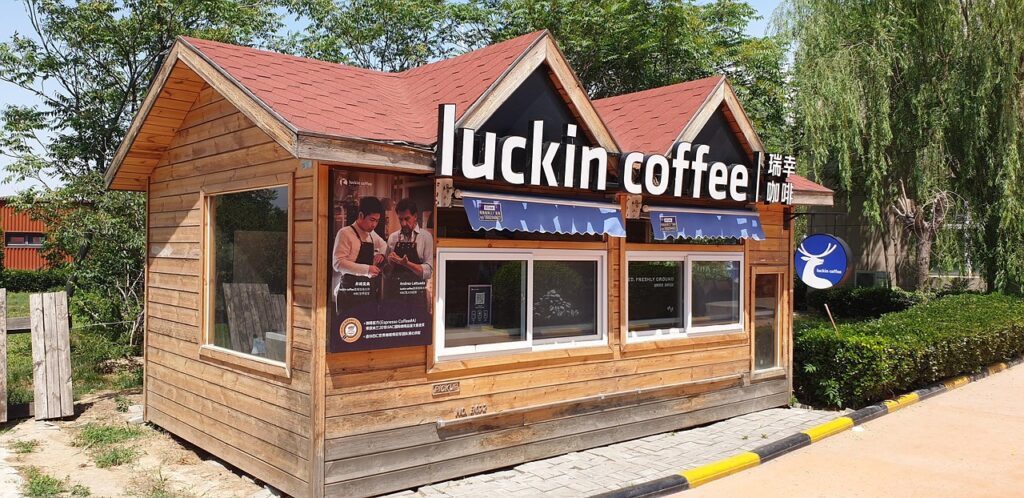

Younger customers are more open to trying new brands and respond well to promotions, making them ideal entry points. Luckin Coffee’s low launch prices in the U.S. demonstrate how tapping into this group quickly builds awareness and influences wider consumer trends.

2. Use Price Incentives Strategically

Introductory offers lower the barrier for first-time buyers and generate quick buzz. Luckin’s US$1.99 launch promotion attracted trial customers, but the real test is converting them into repeat buyers by maintaining value beyond the initial discount.

3. Adapt the Business Model to Local Conditions

What works at home may not work abroad. Luckin reduced costs in the U.S. by running lean, app-based stores with minimal staff and seating—contrasting sharply with Western café formats. F&B brands must adapt menus, store formats, and sourcing practices to meet local tastes and cost structures.

4. Assess Exposure to Trade Risks

Not all businesses are equally affected by tariffs. Product-heavy companies face higher risks, while service-based F&B brands are more insulated. Understanding supply chain vulnerabilities helps owners prepare for sudden policy or economic shifts.

5. Scale Cautiously and Learn Fast

Expanding too quickly strains resources and dilutes brand value. A sustainable approach tests in select urban markets, refines the model, then scales outward. This builds resilience, reduces costly missteps, and wins trust among consumers and investors.

Closing Thought

Expanding abroad is never without risks, but Chinese brands show that careful planning, local adaptation, and targeted engagement can turn challenges into opportunities. For F&B owners, the key lies in understanding the market, connecting with the right consumers, and staying agile—strategies that make growth in turbulent times not just possible, but sustainable.

At Vintage Management, we provide consultation services to F&B owners inspired by this article who want to expand their business to other countries. If that’s you, contact us here for a private discussion.

Related Articles

How Chinese brands might have “unfair advantage” in the Southeast Asian market

Recent Posts

- Livestreaming: A Localization Needed in ASEAN Countries

- Success Stories of Japanese Traditional Brands Overseas

- Impact of Spain’s Pork Import Suspension and the Emerging Potential of Alternative Meat

- Case Study on Chatterbox’s Expansion to Japan: How Local Expertise Attracts Global Brands

- Singapore Employment Pass Update: COMPASS “20-Point” Universities for Overseas Professionals