The sudden Kanada-Ya Singapore exit has sent shockwaves through the local food and beverage (F&B) industry. Backed by Aspen Group, the Japanese ramen chain abruptly closed all outlets following continued financial losses — ending its short but eventful run in Singapore.

A Sudden End to a Prominent Japanese Ramen Brand

Before the news reached The Straits Times, all three remaining outlets — JEM, Marina Square, and PLQ — had already ceased operations.

Public reactions were divided: some diners expressed shock, while others pointed to ramen that lacked distinctiveness. But regardless of opinion, the exit underscores a growing challenge for foreign F&B brands trying to sustain operations in Singapore’s competitive market. Group’s continued financial losses led to the abrupt closure of all Kanada-Ya outlets in Singapore, marking the end of the popular Japanese ramen chain’s presence in the city-state.

Wider Struggles in Japanese F&B Brands

Kanada-Ya’s closure isn’t an isolated case. Japan Food Holdings recently reported losses of $2.9 million, over four times higher than just two months prior. The group also reduced its presence by closing several Konjiki Hototogisu outlets.

For F&B operators, these trends highlight a critical question:

What can we learn from Kanada-Ya’s fall — and who’s succeeding where others fail?

Lesson 1: Deliver Perceived Value — Not Just Food

Lesson 1: Deliver Perceived Value — Not Just Food

A useful comparison comes from Ramen Keisuke Tori King, a consistent performer in Singapore’s ramen scene. Located in Tanjong Pagar, the brand maintains high customer loyalty through:

What Ramen Keisuke Did Right

- A unique chicken broth concept (vs. standard pork broth)

- Free beansprouts and hard-boiled eggs as appetizers

- Strong TripAdvisor ratings above 4 stars

These small touches elevate value perception and encourage repeat visits.

Why Kanada-Ya Fell Short

By contrast, Kanada-Ya offered no complimentary items — a missed opportunity in a market where diners quickly associate “extras” with care and hospitality.

Takeaway for F&B Owners

Don’t underestimate the power of perceived generosity. Small, low-cost add-ons can boost satisfaction and loyalty far beyond their actual expense.

Lesson 2: Optimize Hospitality and Complaint Management

Keisuke’s Approach to Customer Feedback

Keisuke’s team is known for their responsiveness. They address feedback swiftly and turn complaints into opportunities to impress customers.

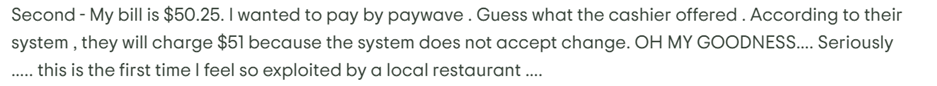

What Went Wrong for Kanada-Ya

Kanada-Ya, on the other hand, suffered from negative online reviews that went unaddressed. Complaints of rude service and deleted social media feedback eroded trust.

In today’s digital era, deleting criticism is far worse than facing it.

Transparent communication builds brand credibility — silence destroys it.

Takeaway for F&B Owners

Train staff to handle feedback empathetically, and always respond publicly to valid criticism. Reputation management is an active process, not a reaction.

Lesson 3: Plan Expansion Carefully

Timing and Site Selection Challenges

Kanada-Ya expanded aggressively — opening at Marina Square (May 2022) and JEM (October 2022) — within just five months. Unfortunately, both sites faced footfall and accessibility challenges.

- Marina Square: Weak weekday lunch traffic compared to Suntec City

- JEM: Complex layout that made the restaurant hard to locate

Review counts reflect this: JEM had just a quarter of PLQ’s review volume.

Takeaway for F&B Owners

Expansion speed should match market readiness. Poor site selection and mistimed openings can destroy profitability faster than weak sales.

Lesson 4: Choose the Right Local Partner

Partnership Mismatch

Kanada-Ya’s Singapore partner, Aspen Group, is a property developer — not an F&B operator. This mismatch likely caused operational inefficiencies and a lack of industry foresight.

In contrast, successful Japanese F&B brands partner with operators who understand local dining behavior, pricing sensitivities, and day-to-day restaurant management.

Takeaway for Expanding Brands

The right local partner isn’t the one with the deepest pockets — it’s the one who understands how your customers think, eat, and spend.

The Bigger Picture

The Kanada-Ya Singapore exit is a cautionary tale about strategy, localization, and partnership alignment. Sustainable success in international markets demands:

- Local market insight

- Operational agility

- Genuine customer focus

At Vintage Management, we help business owners — including F&B operators — build sustainable overseas strategies and partnerships that work.

Interested in expanding your brand?

Let’s discuss your plans: Contact us here

Further Reading

To see more trends in the local industry, check our article on Singapore 2025 F&B closures and Singapore brands expanding overseas.

Curious about other brand insights and F&B case studies?

Explore more articles on See & Connect

Recent Posts

- Livestreaming: A Localization Needed in ASEAN Countries

- Success Stories of Japanese Traditional Brands Overseas

- Impact of Spain’s Pork Import Suspension and the Emerging Potential of Alternative Meat

- Case Study on Chatterbox’s Expansion to Japan: How Local Expertise Attracts Global Brands

- Singapore Employment Pass Update: COMPASS “20-Point” Universities for Overseas Professionals